Investment Strategy

- RootCorp provides Institutional, Ultra High Net Worth Family Offices & Accredited Investors with vetted & targeted investments that can offer superior returns on a risk adjusted basis.

- Aided by proprietary technology, RootCorp will be able to process augmented deal flow and remove layers of friction costs and fees typically associated with Investment Grade Real Estate acquisitions and provide its investors direct access and ownership in real estate that was previously accessible only by large institutional players.

- Strong emphasis is placed on deals with a margin of safety and defined exits within 3-5 years.

- RootCorp has access to a steady flow of deals through its experienced acquisition teams, its Strategic Alliance Partner network and direct relationships with CEO’s of property and infrastructure companies.

- RootCorp primarily focuses on multifamily properties as this asset class is the safest and less prone to volatility as other sectors of the real estate market.

- Additionally, since RootCorp's strategy is to strive to provide its investors steady cash flow as well as capital gains on every investment, then the obvious safer choice would be multifamily properties.

- Particular attention will be paid to the suburbs of the major metro areas and secondary markets as these markets tend to "fly below the radar" of the big institutional investors and therefore Investment Grade properties situated in these locations which meet certain demographics criteria, provide higher yields at almost the same risk as the major metro CBDs.

- Demographics, diversity of employers, easy access to public transportation or major highways as well as regional economic drivers are the keys to success.

- Vehicle flexibility- In the ever dynamic commercial real estate sector, lucrative investment opportunities can arise through traditional asset acquisitions, as well as recapitalizations of distressed properties suffering from underperforming property operations or in need of capital expenditure. RootCorp will actively invest in the core through value add space as our investment platform will provide the flexibility to capitalize on various opportunities through equity investments and efficient debt financing, customizing each investment in the most secure yet profitable structure for that investment.

Acquisition Criteria

Demographics: RootCorp will invest in select properties located in markets that show positive demographic potential. The market will have strong economic and rent growth, strong employment trends and a diversity of employers, vacancy compression as well as other specific criteria.

Location: Major metropolitan areas. Secondary markets may be considered when characterized by exceptional growth and demographics.

Hub and Spokes/Mushroom: In the markets that RootCorp identifies as investment worthy, RootCorp will strive to invest in properties that are relatively close to each other geographically to streamline property management costs and also to accumulate enough mass so as to utilize multiple exit strategies ranging from an individual property, a regional portfolio, or a national portfolio.

Local and Strategic Alliance Partners: In order to augment deal flow and provide a wider diversity of investments, RootCorp will attempt to recruit reputable local partners who will, once vetted, share the general partner duties with RootCorp in return for having significant "skin in the game." However, RootCorp will not shy away from closing on deals where RootCorp is the sole general partner.

Asset Class: Core through value add properties. Rehab properties may be considered when accompanied by exceptional metrics going forward and a significant upside.

Deal Size and Unit Count: $10,000,000 and up with 150-200 apartments minimum with a preference for larger properties.

Targeted Returns:

- Value add projects- At least 5-6% cash on cash in year 1. Target IRR mid to high teens.

- Stabilized projects- At least 7-8% cash on cash in year 1. Target IRR low to mid teens.

Click below to see

Transactions

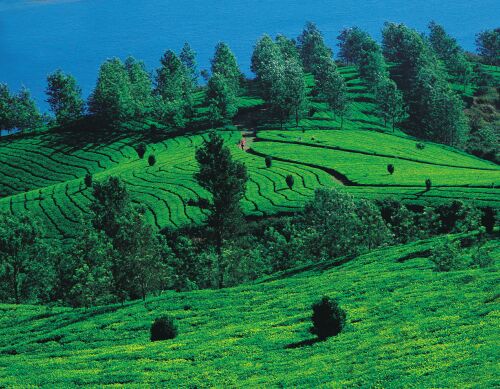

The Nichani Group has successfully transacted properties in commercial and residential real estate, serviced land, and plantations.

Nichani Group:

Investment Transactions